Bursar Bulletin: What Chime's IPO tells us about the next-generation of students

Chime, a FinTech company, is going public. Their story is about addressing the most critical financial needs of everyday Americans - the next-generation of students.

Chime is going public - an exciting time for Fintech, sure, but also a huge point of validation for a company that took on the large incumbents by bringing banking services previously reserved for the rich, to the masses.

What Chime has been doing in consumer banking has broad parallels within Higher Education, and their IPO filing provides some interesting insight into who your future students will be - and perhaps more importantly - who the future parents of those students will be, and what they value in financial services (ie their interaction with you).

I read through their filing (so you don’t have to - SEC documents can be a real bore), and want to take you through the important parts:

Who is Chime and what they have achieved?

The insight their filing gives into the next-generation of students (and parents)

What this might mean for your Bursar and Financial Aid office?

Who is Chime and what they have achieved?

Chime is one of the first-generation financial technology (FinTech) companies that burst onto the scene in the early 2010s. They got their start as most FinTechs did back then - taking banking services that were primarily offline and available to a select few, and bringing them online and available to the millions of everyday Americans who had previously been ‘under-banked’.

Who are their customers?

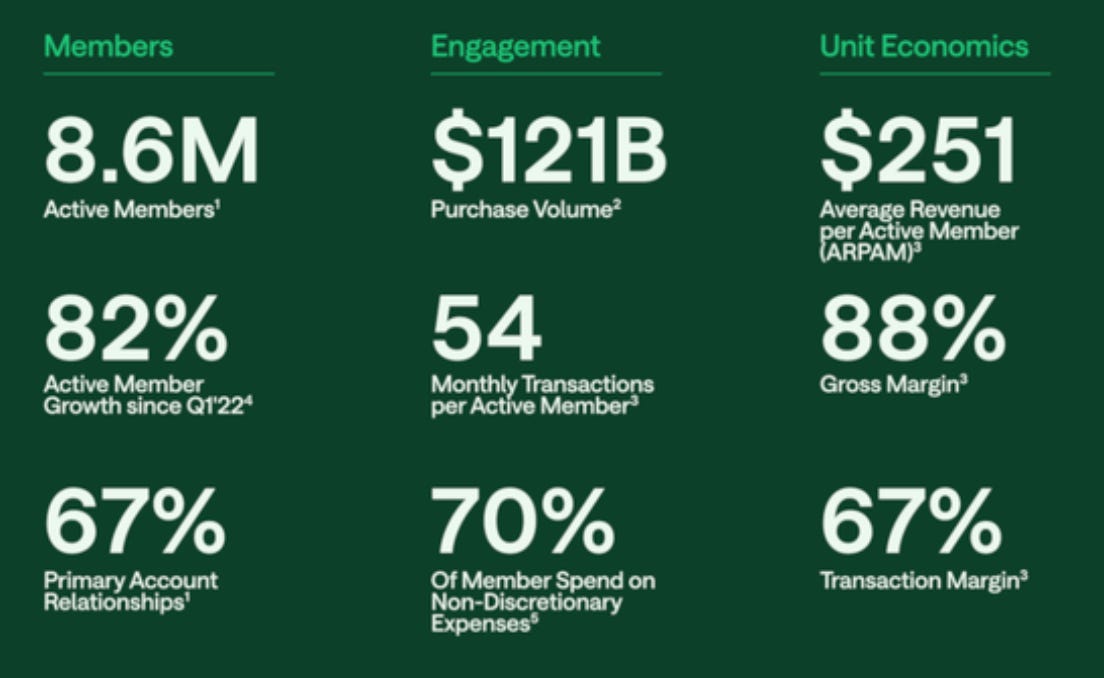

Chime focuses on the 75% of the adult population that earn up to $100,000 annually that “have struggled with bank relationships that are not always aligned with their best interests”. About two-thirds of their 8.6 million customers use Chime as their primary bank account - no small feat when up against the likes of Chase and BofA.

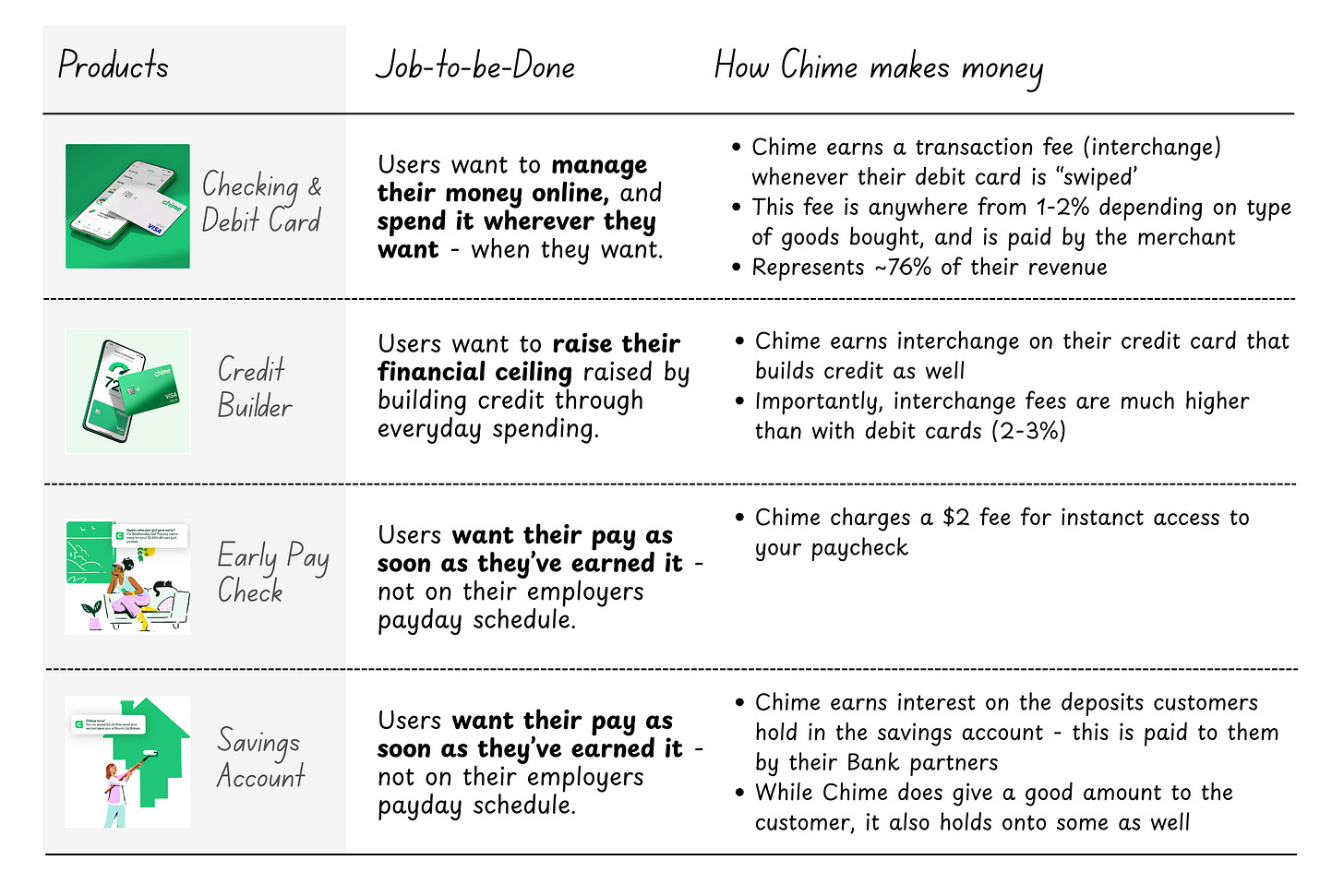

What are their products?

Chime does a pretty good job of aligning its products with its users needs (or Jobs to be Done - a framework I love and we use all the time at Backpack). Here is a summary I put together of their products.

What have they achieved?

A lot! They have over 8.6 million users that are making $140 billion worth of purchases using Chime’s products on an annualized basis. They make a good amount of money off it too - $251 per year of each active member to be exact.

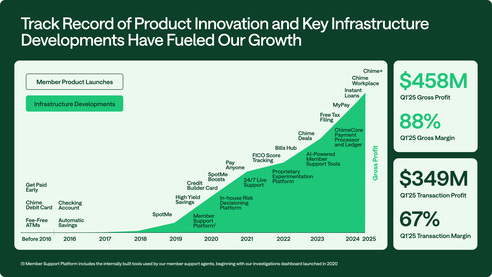

It also shows that it does take time to build something like this - Chime was founded in 2012, with most product prior to 2016 being focused on their core checking account and debit card. 2018 was somewhat of a breakout year and, as they say, the rest is history…

What does this tell us about future students (and student parents)?

The statistic that really stood out to me in Chime’s filing was their repeated emphasis on their core target market; the 75% of everyday Americans that earn less than $100,000 a year. On a post-tax basis, this is more likely to be $75k-$85k (depending on which state you live in).

This really spoke to me because I think it says something about the next generation of individuals and families moving into the lower-middle/middle class. This has happened many times over the decades - where new cohorts of Americans have moved into middle class through the proliferation of new industry, technology or financial innovation (think manufacturing, Wall street etc.).

In this case, the breakthrough is more of a technological one, where more folks are finally getting access to financial services (which is a big part of moving through the class system). What we also know is that an outcome of wealth building is education -meaning these folks will start to make up a larger and larger portion of our enrollments over the coming years.

Why is this important?

This is important because never in our history have we had such a high annual income to tuition ratio (ie tuition takes up way more of our average annual salaries than it ever has) - also no surprise to anyone.

Look at the side-by-side comparison of $100,000 annual salary (pre-tax) against annual tuition - and keep in mind that 75% of America sits below $100K. This doesn’t even factor in cost of living for the student, let alone everything else they have to deal with!

What else is interesting?

Chime is bringing online-banking services directly to these customers, a lot of whom used Chime as their very first bank. This means these folks will be digitally-native, and are going to struggle with processes that don’t match. Chime actually as a peer-to-peer payment capability too - kind of like its own internal Venmo.

What do both of these things mean together? It means that an increasing portion of students and their parents will be under more financial pressure in piecing together money for tuition, and they will look to digital tools to help them.

What are the takeaways for the Bursar office?

I took three big things away from reading Chime’s IPO filing and writing this:

1. Student families will get tuition funds from more sources

More emphasis will be placed on piecing together tuition funds from multiple sources than ever before - driven by the fact that tuition inflation has dramatically outstripped the rise in annual salaries and wages.

The idea of that single payment to University (ie Mom or Dad sending one check, or swiping one card) is going to go out the window. Instead, it will be replaced (and already is) by a fairly complex cobbling together of funds from different savings vehicles (prepaid tuition, 529 plans), family and friends (grandparents, godparents, divorced parents), sponsors (business sponsors, government sponsors) and scholarship providers.

To me, this means that we should be thinking more about how to build a cohesive payment experience inclusive of these new fund types - something we think about a lot (and are building) at Backpack.

2. A digital payment experience (not just payments) needs to be prioritized

Customers and consumers win when there is choice - it leads to competition, and competition leads to better outcomes in terms of quality and price of product. For example, the reason that some business don’t accept AMEX is because they charge a much higher fee versus Visa and Mastercard - but they also know that they’ll be fine because lots of people have Visa and Mastercard (ie competition).

However, the choice that is provided also needs to be displayed in an intuitive, easy-to-use way. The way we highlight an option (or not) may end up with student families paying more (or less) fees. This makes it extremely important that we provide student families with easy to find (and understand) resources about what their options are, and what each might cost. Some ideas are:

Revisit your Payment Options page - does it clearly articulate all the options you offer, and highlight what the differences are in terms of service and price?

Are you providing financial and payment toolkits to families? We do this a lot for FAFSA and financial aid, but not as much for the bottom of the payment waterfall stuff.

Are there payment options you should add (or remove)? Have you thought about what accepting Zelle, Venmo or PayPal would look like (reach out if you have - or are now - as we think about this a lot!)

3. We can do better in reducing “Paying to Pay” fees

I actually had the pleasure of meeting Chris Britt, the Founder/CEO of Chime, once - and we chatted briefly about why he started Chime (at the time I was an excitable 20-something keen to start my own business one day). His response was pretty simple, in he just saw that banks ripped off lower-income families with random, harsh fees that meant they could never really progress in their financial lives.

I think we really can and should get rid of ‘paying to pay’ fees (a term we coined here at Backpack). We did a little research and we estimate the student families pay somewhere between $35-$70BN in fees associated with the purchase of education expenses. Let’s take the lower end of the range - that’s the equivalent to sending 1.5 million students to an in-state public university every year.

I have seen some universities actually remove the option to pay with debit and credit cards because of the fees - it’s a bold move because perhaps this does impact some enrollments that can’t pay outright - but it also is a great move because it doesn’t push them into a credit card debt trap (even if they need to use debt, credit card debt is the worst and most expensive!).

Wrap-up

Technology is bringing finance to everyday people. That is what FinTech is all about - using new technology to reach a new audience, raise awareness of good financial habits, provide more efficient and lower cost alternatives, and improve financial outcomes for the vast majority of Americans that aren’t banked by the Goldman Sachs of the world.

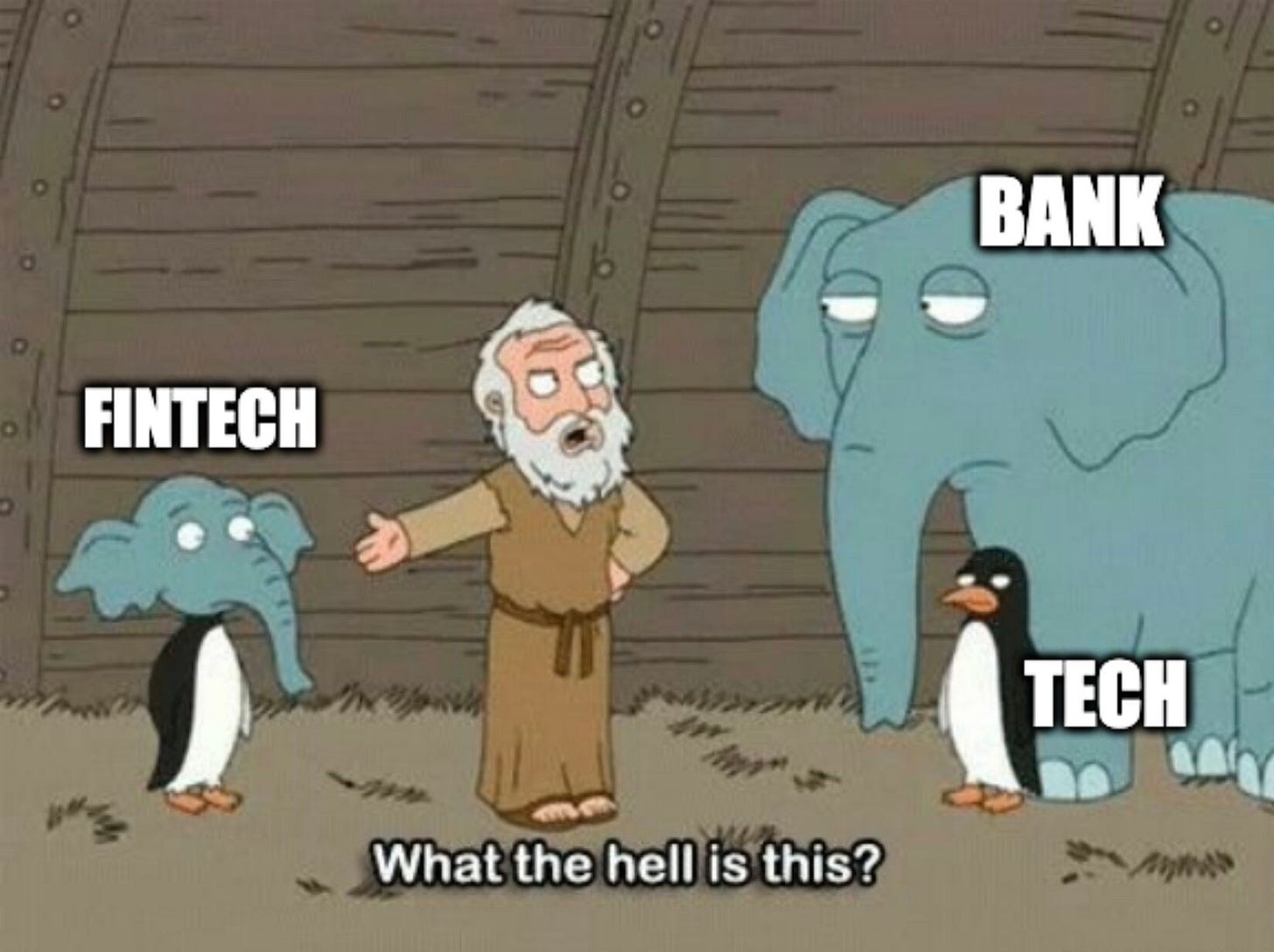

Finance and technology may sometimes feel worlds apart, and I always enjoy this meme below, but Chime has proven that when done correctly and methodically, it can serve as a game-changer for those who need it. We are also excited to be working toward that here at Backpack!

Quick shout-out to our friends at the PacWest Bursar Conference we attended last week (photo below with our new friends at Point Loma). I am excited to have been brought onto the organizing committee for the next couple of years - a continuation of Backpack’s commitment to bring more education and training resources to Bursars!

See you next week.

Cal

Great illuminating article on the problems lesser paid struggle to send their children to higher education. Applies equally in the U.K.