Bursar Bulletin: What actually made it into the final Big, Beautiful Bill?

Dramatic changes to financial aid and higher education were included in the original BBB; I go through what made it and what didn't.

About a month ago, I wrote a detailed report on the dramatic changes being proposed to financial aid and higher education more broadly under the House-passed version of the Big, Beautiful Bill (“BBB”).

On the 4th of July, the President signed into law the final version of the BBB; while some proposals remained, there were some significant revisions to what was initially proposed. Today I will:

Talk through the biggest, most impactful areas of revision

Significant revisions to Pell Grant eligibility and award sizing

Removal of proposed Median Cost of College

Dropping of institutional risk-sharing proposal

Lowered endowment tax proposals

Provide you with a detailed summary of all the material revisions

Where were the largest revisions?

Pell Grant Eligibility

The Pell Grant provisions underwent significant modifications throughout the legislative process, with the Senate and final bill providing substantial relief from the House's more restrictive proposals.

What was the House-passed proposal?

Increased Credit Requirement: Increased the amount of coursework required for students to get the max Pell Grant to 30 credits per year, or 15 credits per semester

Half-time: Students to be enrolled at least half-time to maintain eligibility. Students taking fewer than 8 credits would no longer qualify for a Pell Grant

Scholarships: Eliminated Pell for students with full-cost scholarships.

Workforce Pell: Expanded eligibility for the Pell Grant to students enrolled in short-term job training programs (including unaccredited institutions)

More than half of all students currently enrolled in higher ed institutions across the country would fall short of a full course load and see their grants shrink under the House's proposal. A student now taking 12 credits in a term and receiving a full Pell Grant will only receive 80% of the Pell Grant maximum, currently set at $7,395

These proposed cuts might have reduced access for over two million students.

What actually passed in the final version?

Credit Hour Requirements: Maintained current credit hour requirements (24)

Part Time Student: Preserved part-time student access. Students can still receive Pell at current enrollment levels.

Scholarships: This was included in the final version, meaning students receiving aid covering full cost of attendance excluded from Pell eligibility.

Workforce Pell: Despite some drama (where at one point unaccredited institutions were removed), the expansion of Pell to include workforce programs passed largely as put forward in the House version (which I think is great!)

Pell Funding: $10.5BN in funding was approved to fund the Pell shortfall.

These revisions are, for the most part, a huge win for students. The majority of the most severe changes have been revised down, and this now feels less like a major shake up of the Pell system, and more a slight revision.

Median Cost of College

What was the House-passed proposal?

The House included a provision changing the calculation of a student's need as the median cost of college (MCOC) minus the Student Aid Index (SAI) minus other financial aid, beginning with the 2026-27 aid year.

The House proposal would have:

Used the national median of all programs with the same 6-digit Classification of Instructional Programs (CIP) code at the same credential level, meaning need would be capped at a figure lower than the institution's actual cost of attendance (COA) for half of all institutions

Capped annual federal student loans at the "median cost of college of the [student's] program of study"

Set the annual limit as the national median cost of the specific program of study, less the amount of any Federal Pell Grant received by the student

What actually passed in the final version?

The median cost of college concept was entirely absent from the final legislation signed on July 4th. Instead, the final bill maintained current cost of attendance calculations and loan limit structures, representing a significant victory for higher education advocates who warned the MCOC system would create chaos and reduce aid for students at higher-cost institutions.

This was one of the most significant reversals between the House and final versions, as the MCOC proposal would have fundamentally changed how financial aid is calculated for millions of students.

Why the change?

In the end, the primary reasoning behind scrapping the MCOC proposal was implementation and data concerns.

The Department would have needed to construct the median cost estimates by program at the national level and conduct data verification and dissemination to schools, but data on the cost of attendance data by program on which they all rely does not currently exist.

NASFAA also had serious concerns about institutions' ability to offer their own aid funds under this proposal, as well as many questions about how such a complex framework could be operationalized.

Institutional Risk-Sharing

What was the House-passed proposal?

The risk-sharing proposals for higher education underwent significant changes between the House-passed version of the "One Big Beautiful Bill Act" and the final legislation signed on July 4th, 2025.

The original bill included a comprehensive risk-sharing system that would have:

Required colleges to cover a portion of the costs when students do not earn enough to pay down the principal on their loans

Required colleges to make annual payments based on how much former students owe in unpaid loans

Used a complex formula to charge institutions an annual fee for their students' unpaid loans, affecting the vast majority of colleges

The Congressional Budget Office estimated these risk-sharing payments would total $1.3 billion by 2034 and continue increasing annually.What actually passed in the final version?

The Senate version "walks back the House's controversial risk-sharing plan" and instead replaced it with an earnings test similar to gainful employment rules.

Under the Senate approach:

Undergraduate programs could lose federal aid eligibility if their former students earn less than the median adult with a high school diploma

Programs that fail the test for 2/3 consecutive years would be cut off from loans

What changed and why?

All in all it feels like Higher Education Institutions can sigh a bit of a relief. Here is a summary of the changes:

No financial penalties: Unlike the House version that would have required colleges to pay billions in annual fees for unpaid loans, the final bill uses an earnings threshold system

Program-level consequences: Uses students' earnings to hold colleges accountable by potentially cutting off federal aid access rather than imposing direct financial payments

Less disruptive: This version of accountability is likely less disruptive given the removal of billions in penalties, however, the enforcement will be key here - the question still remains how calculations will be made and compared.

The changes were made as the House risk-sharing proposal faced significant criticism for being overly complicated and nearly impossible-to-implement and potentially harmful to institutions serving low-income and minority students.

Endowment Taxes

What was the House-passed proposal?

This was the most aggressive proposal, and likely that way as everyone knew whatever they started with would be revised down after intense lobbying and PR efforts.

The proposal was to change endowment taxation from a flat 1.4% rate to tiered system, based on how big the endowment was on a per student basis:

1.4% for $500K-$750K per student,

7% for $750K-$1.25M,

14% for $1.25M-$2M,

and 21% for $2M+ per student

This also included some general calculation and coverage guidance:

Maintained 500-student minimum threshold

International students could no longer be included in enrollment calculations, affecting institutions like Columbia University

Included exemption for "qualified religious institutions"

The reality was that the top tax rate (21%) was only ever going to apply to three universities; Princeton, Yale, and MIT, with another 10 hit with the 14% rate

What actually passed in the final version?

The final bill did adopt a tiered tax structure, though the size of the tax increases were significantly pared back:

1.4% for $500K-$750K per student,

4% for $750K-$2M per student,

8% for $2M+ per student

The enrollment threshold for which schools this applies to did increase to at least 3,000 tuition-paying students, resulting in smaller schools not being subject to excise tax regardless of endowment size.

Rice published what it believes the impact of the changes will be; they expect to pay $10.1M in annual endowment taxes under the new structure, roughly double what it currently pays. That extra ~$5M roughly translates to 75 students worth of tuition (based on their 2025-26 tuition cost of attendance figure).

Detailed summary of all changes

Here it is! Your cheat sheet for what actually made it into the final version of the bill. The short story is a lot of reprieve from the initial House passed version, particularly when it comes to Pell Grant eligibility and needs-based analysis.

Hopefully this comes as good news, and feels a little more digestible as we enter in the busy period for Fall tuition!

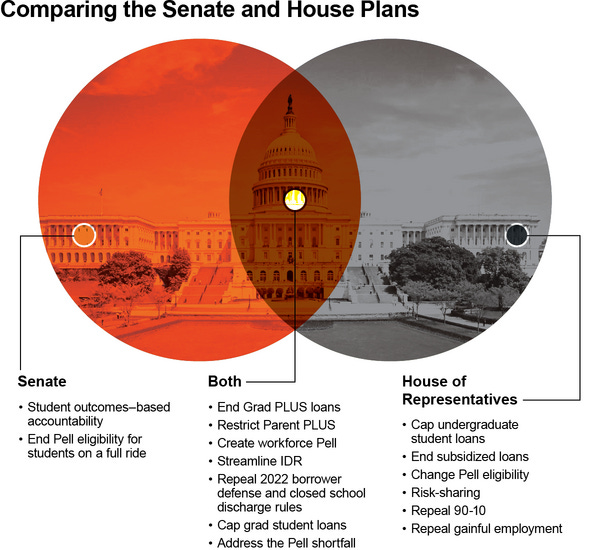

I also found this visual to be a good one from the folks at Inside Higher Ed.

Wrap-Up

That’s all for this week folks! Hope everyone had a fantastic 4th of July weekend, and look forward to next week.

Cal

A few thoughts on the BBB. Boring, not Beautiful, yet I approve with the Naughty by Nature Stamp.

https://torrancestephensphd.substack.com/p/you-down-with-bbb-yeah-you-know-me