Bursar Bulletin: The week where stablecoins and crypto hit 'mainstream'

A flurry of product launches, acquisitions, partnership announcements and regulatory activity likely makes this week the week digital currency became mainstream.

For the longest time, crypto as an industry has been plagued with bad actors and fraudulent stories that have held back its adoption in the mainstream - that is, until now. The next question that is likely on your mind is why now? What changed?

You might remember that a couple months ago I started talking about a certain style of cryptocurrency that I thought had real momentum behind it; stablecoins. I talked about what stablecoins were, and why they were starting to see adoption in the real world. Stablecoins, a type of digital currency, have one very important distinction from all the others - their value is pegged to an actual currency (ie the USD, JPY, GPB etc.).

In a hypothetical example, this would mean that for every 1 Stablecoin you own, there would be USD$1 that is being held to back that value. In quite an ironic way, it isn’t too dissimilar to how the Federal Reserve stored massive amounts of Gold in Fort Knox to back the value of the United States Dollar. What this now does though, is gives us an electronically-native, cheaper and near real-time way to trade (pay) with each other across geographies.

This is what has changed. And, oh boy, did things really ramp up this week.

Alright, I’ll get to it - here’s what happened…

Stripe announced it is launching stablecoin backed payments to 100+ countries (in partnership with a US chartered bank - Lead Bank)

Meta (Facebook) announced it is launching a new stablecoin, roughly three years after it shut down its initial crypto project (you might remember LIBRA if you used Facebook messenger to back in the 2010s)

Congress passed the FIT21 2.0 bill - which “provides the regulatory clarity and robust consumer protections necessary for the digital asset ecosystem to thrive in the U.S.”.

Ramp, a Corporate Card company (think of them as one of the modern versions of the green Amex), launched a company card backed by stablecoins.

Visa invested $50M into BVNK, a stablecoin infrastructure company

Coinbase announced a $3.2BN acquisition of Deribit, a derivatives trading company - the melding of traditional and digital finance (and also became the first crypto company to join the S&P 500!)

Cash App launched use of Lightning, giving its users a way to send and receive Bitcoin instantly, with no fees, anywhere in the world.

How will this actually impact payments?

Well, as you can see, very mainstream payments brands (Stripe, Visa etc.) are betting billions of dollars on stablecoins being the next frontier for payments. This is really the first time that everyday consumer brands are adopting this technology to replace more traditional payments rails.

Will you see this in your daily life? I actually don’t think so. Stablecoins have amazing benefits for cross-border payments, but really don’t have too much applicability. Sure, they would work if you wanted to apply them to domestic/US payments, but there isn’t really any point. Technologies like FedNow, the real-time payment framework adopted and promoted by the Fed, has much more real-life applicability to your everyday. So don’t worry, don’t expect to see “Pay by Stablecoin” at your local H-E-B, Trader Joes or Buc-ees anytime soon!

Where this does have very real impact is international payments. I’m sure most of you have made a payment to someone overseas - whether you are paying a vendor overseas, sending money to a family member or friend, or buying currency ahead of a trip. This is really where stablecoins come into their own - the idea is that you never actually have to do the converting into the foreign currency. The stablecoin, lets use USDC as an example, acts as the conduit or middleman between you and whoever you are paying. Essentially, all you have to do is own some USDC, and then pay that USDC to whoever you want to pay. They can then either spend/pay that USDC somewhere else.

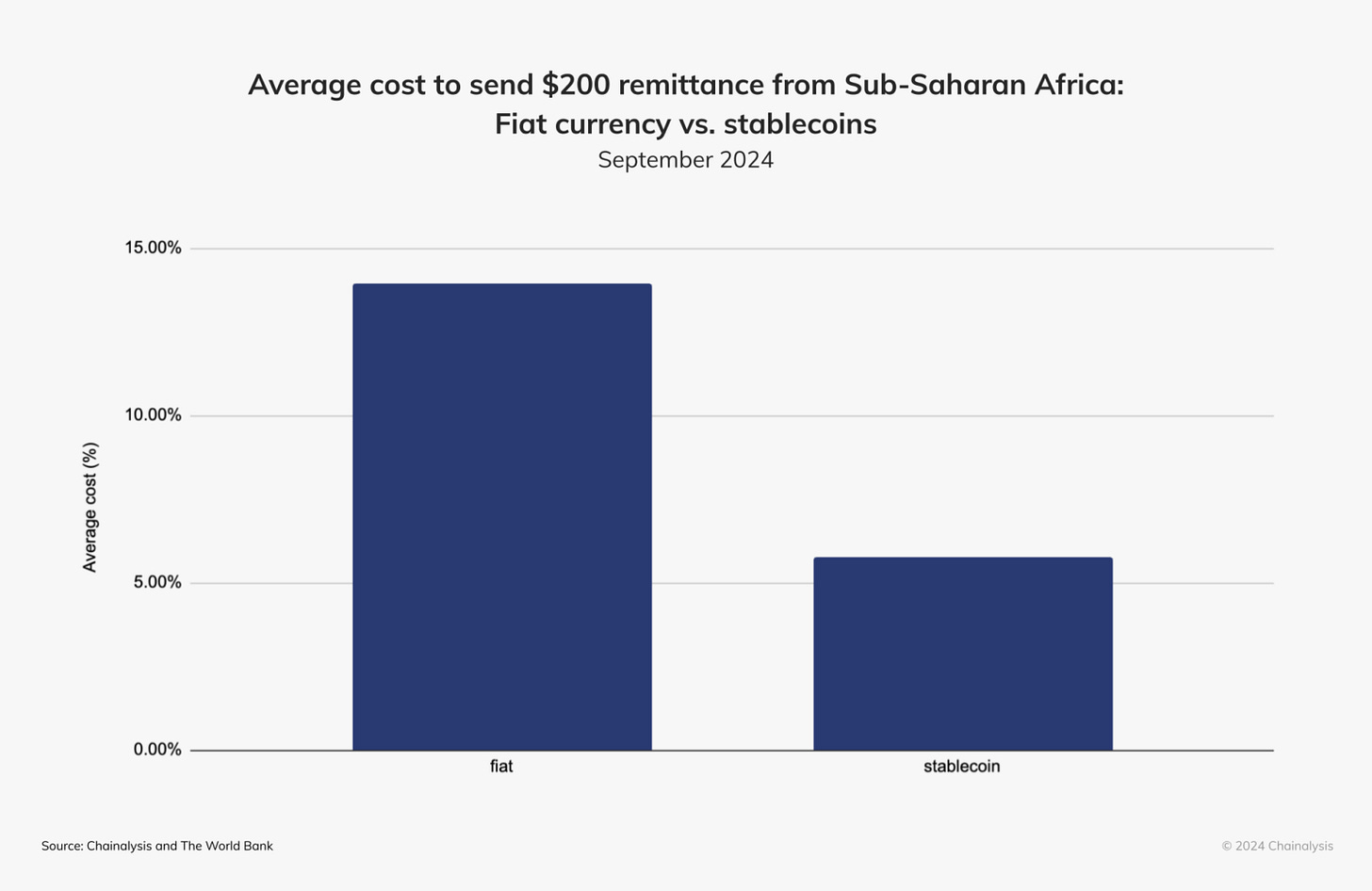

Here is a really good example of where stablecoins are useful. This graphic shows that, stablecoins can reduce the cost by nearly a third of what it usually costs for traditional (fiat) currency from sub-saharan Africa.

If interested, I can’t recommend enough Chainalisys’, Stablecoins 101 report. It’s a ~10 minute read, but will get you very up to speed by the end of reading it.

Will we see this in the Bursar Office?

YES! I know - I’m being a bit dramatic, but I really do think so. In the rest of the world, and particularly in China and the Middle East, adoption of these new digital assets is skyrocketing. And where do a ton of international students come (and pay) from? You guessed it..

International students currently pay thousands of dollars in fees for making payments to Universities - and they will be looking for ways to stop doing that. I really do think providing alternative methods of payment will be a real differentiation point for attracting international students, particularly as the competition heats up for them given the backdrop of lower international immigration (and therefore enrollments). It’s not ridiculous to think that there will be lists in circulation in these countries of which universities accept stablecoin payments - and that’s a list you’ll want to be on.

I also want to bring up an infographic I created a few months ago - this (simplistically) tells the story of what changes for an international payment between the current tech, and a stablecoin payment. Hopefully this gives you a sense of why this will be transformational, and will very likely be something you need to plan for in the not too distant future.

Wrap-up

I hope this was interesting and informative. Stablecoins will be a foundational component of payments for decades to come, and keeping up with their progress is important.

On another note - the team and I will be in Santa Barbara this week at the PacWest Bursars conference. Please stop by and say hi at our booth if you will be there!

See you next week.

Cal