Bursar Bulletin: The first one

Zelle crosses $1T in transaction volume, 529 reaches its own milestone, and we give a sneak peek at next weeks Bursar Highlight.

Hello there!

Excited to be writing up the first (of many) Bursar Bulletins.

I wanted to start off with two timely news pieces that neatly sum up why I believe Bursar offices (and anyone who is dealing with bringing money into the University in the form of tuition payments) are primed to be the innovation leaders for their Universities. These news stories exemplify that:

There is a huge (and accelerating) shift in payments technology

Universities that are ready to innovate and adopt these shifts will win in an age where education affordability (and therefore enrollments) is stressed

Bursars, being the frontlines for tuition payments (ie revenue and cashflow), own the opportunity to innovate and push their University ahead of the pack

Enjoy the read and please send through any and all thoughts/feedback!

ps if you missed our Introduction to the Bursar Bulletin, read it here.

What’s newsworthy this week?

Zelle crosses $1 Trillion payments

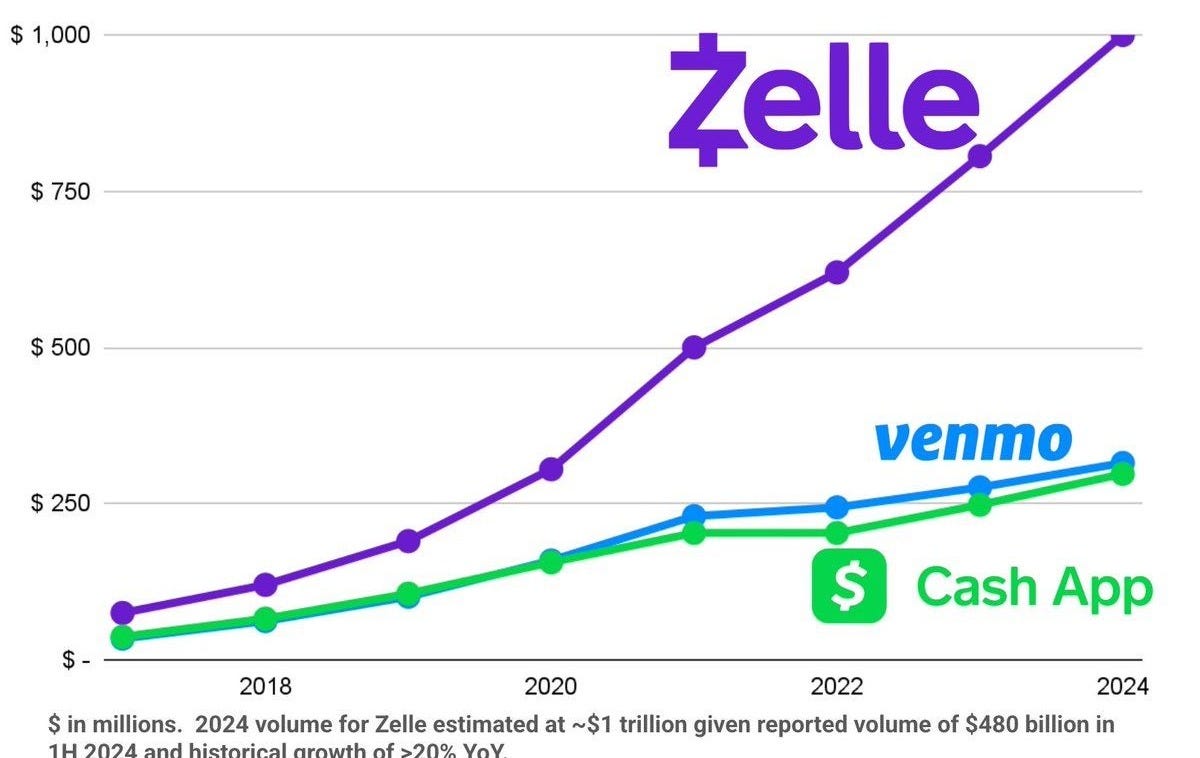

Zelle just crossed $1 trillion in transaction volume. For those that don’t know Zelle, it is a peer to peer (P2P) payments platform that enables payments to be made really easily from one bank account to another - it is essentially an alternative to cash, paper check, making a manual ACH/wire payment or using another P2P service like Venmo or Cash App.

Why is this a big deal? Zelle is actually owned and operated by a consortium of Big Banks (yes I know, “those” guys). They were able to leverage their existing customer base to dramatically outgrow their competitors. Read more here.

What might this mean for Higher Ed? Well, when the big banks start to put their energy behind something it (almost always) ends up being a fairly large part of the US banking system. Zelle can be used to make payments into business accounts as well (like Venmo Business). It’s interesting to ponder on what accepting Zelle payments for tuition means and looks like. I am waiting for the first Bursar to receive an email from Zelle saying “someone is trying to send you a payment”… let’s see.

What I think is more interesting about this insane rate of adoption for Zelle is what it represents more broadly. Since 2010, new payment types are coming to market quicker than ever in history. At first the adoption of these was minimal, but we are now starting to see these new payment types being adopted at huge scale very quickly.

I think about this in the context of how Universities accept payments and how that will evolve over the next decade. In my mind, the key is not how do we add more payment methods - there is only so much space on a “Payment Options” page after all - but rather how do we build a platform that is flexible enough to accept payments however student families want to pay. Said differently, how do we build a platform that empowers bursar and business offices to be nimble themselves and use payments as a differentiation point for student families, rather than being treated as the dreaded “collections”. If the right infrastructure and connectivity is in the right hands, it becomes much easier to spin up a way to accept a tuition payment you hadn’t previously, versus waiting on large tech companies to release something over years long timeframes. That’s what excites me.

What might that actually look like? Right now payments is a very decentralized, distributed thing that exists across multiple teams. Bursars are often hamstrung by the limitations of their existing payment portal, reliant on their banking teams to relay “money in” information (hopefully in a timely manner), and - even worse - often still need to work in the physical universe of cash and paper check. Now, do I think that it is realistic to say “let’s innovate and say no to cash and check”, do a victory dance and drift off into the bliss of a purely online payment sunset? No. Do I think that it is going to take intention to innovate, realistically being driven from the bursars office? Absolutely.

My view is that Bursars should be given control and have a real-time view into both information (ie this student family is going to pay this way, and it may take a while to get funds in) and payments (money arrived today). As cost of tuition continues to increase, these complex payment types that require information workflows atop the payments themselves will start to make up a larger percent of total tuition payments.

ps Zelle partnered with HER CAMPUS to put together a nice Send it Safely campaign on best practices for students using digital P2P payments services. I always like these things as an educational resource for students.

529 hits 17 million accounts and $500BN in assets

I can only imagine that everyone here knows the three numbers 529 - and are probably plagued by the mountain of paper checks that seem to be increasing every semester from them. If it seems like you are seeing more and more of these 529 payments, don’t worry - you aren’t the only one.

Section 529 (yes, I also want to meet the marketing genius behind that one) was passed as legislation in 1996, with the first material cohorts of accounts being opened in the early 2000s. If you think about the time it takes for a kid to reach college age, it makes total sense that we are only now seeing material amounts of outflows coming from these savings accounts (ie those paper checks you are dealing with).

This week, end-of-year data was released for the state of play of 529.

– 17.0 million accounts invested $525 billion in assets in 529 savings and prepaid plans

– 16.1 million accounts invested $500 billion in assets in 529 savings plans

– 0.9 million accounts invested $25 billion in assets in 529 prepaid plans

Even more interesting to me (and should be to you) is how the acceleration of 529 outflows is playing out. 529 now makes up nearly a third of all higher education savings in the US, yet only accounts for less than 10% of total payments each year - meaning a tidal wave of 529 is coming. We (Backpack Research) estimate that over the next five years we will more than double the total dollar volume of 529 funds being used to pay for education expenses to over $100BN annually.

The unfortunate part is that these 529s themselves have not kept up with developments in payment technologies and often rely on paper check. This is putting added stress on your student families, as they have to navigate very complex and lengthy processes to actually get money out of these funds. This can create a lot of anxiety, particularly if there is a time crunch in getting money to you before the payment deadline.

Next week we will deep dive on how a couple of our partner Universities have taken some of the helpful lessons from Third Party Payments and Outside Scholarship payments to make 529 a much simpler and less stressful process for student families - after all, less stress leads to higher enrollments, better retention, and generally better outcomes for students.

Quick Hits

- FedNow releases its latest payment volumes.

- Stablecoins are the new Administrations first big crypto priority

- VoiceCare AI launches agent led approach to health care admin tasks (if they can do it with HIPAA, we can do it with FERPA!)See you next week!

Cal