Bursar Bulletin: How Global Trade Tantrums Hit Campus Cash Flows

I discuss how I think tariffs will impact higher education, and how the Bursar offices can take steps now to help alleviate a trade war hangover.

Whatever you think about the current tariffs and trade wars, one thing is for certain - they are here and will be a big economic factor for years (if not decades) to come.

I thought it might be helpful to take more time to think through details of what the tangible, short-term impacts might be, what that might mean for higher ed in the longer term, and what Bursar offices can do to help soften the blow.

Short-term pain; with long-term gain?

University budgets will be squeezed further than they already have been

The hard truth: University financial budgets are feeling the squeeze on multiple fronts.

Tariffs are directly driving up the cost of goods and services imported into the U.S. — and universities are major buyers. This isn’t just about laptops or software: it’s steel and concrete for renovations, electronics and hardware for campus maintenance, energy for keeping the lights on — and likely fewer eggs at the dining halls 😉.

While the full inflationary impact of these tariffs will take time to unfold (and week-to-week shifts are still happening), there’s already broad consensus: prices are rising. That means university operating budgets are getting more expensive.

Meanwhile, tariffs are also fueling major market volatility. In the days following the April 2 announcement, the S&P 500 dropped more than 12% before rebounding. While this directly dents endowment values, the bigger risk is more subtle: endowment managers are likely to be more cautious with drawdowns amid the uncertainty, putting even more pressure on annual budgets. Add to that the ongoing and expected decline in international student enrollment (more below).

Bottom line: University budgets are heading into a period of significant squeeze over the next 6–18 months. Project dollars will be harder to find. The ability to show strong ROI and make airtight business cases — for new and existing resources — is about to become more important than ever.

Inflation will place more day-to-day financial pressure on students

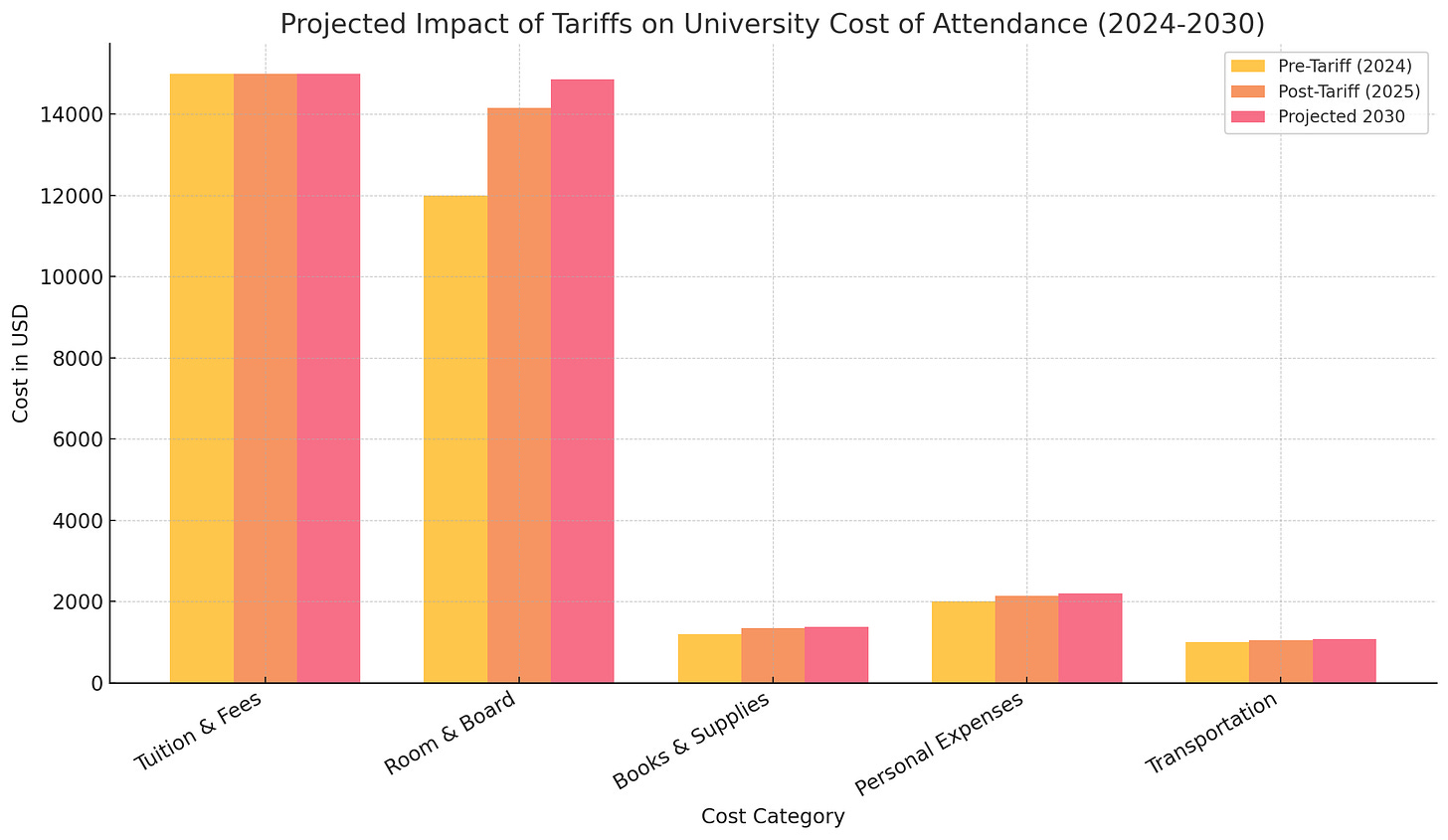

I decided to do a little scenario modeling on what the tariff impact may be on students and their annual cost of attendance estimates - it wasn’t pretty.

📈 In 2025, the average student would pay $2,494 more per year, which is about a +8.0% increase compared to pre-tariff costs.

📈 By 2030, the average student would pay $3,328 more per year, representing about a +10.7% total increase compared to 2024.

Here is what the chart version might look like…

Now please keep in mind, these are estimated judgments - but even if I was off by a country mile on these, it still wouldn’t be a good outcome for students.

Hiring freezes will persist for longer than expected

While I talk about why budgets are squeezed above, one symptom I am hearing a lot about right now is hiring freezes. I expect that economic uncertainty (and volatility) that is more than likely to persist over the next 12-18 months will force administrators to keep these in place longer than everyone probably expects. However, I do think that budget for technology will open up sooner - particularly when business cases are put together well in that they make existing staff more productive.

International enrollments will be down

While there is no perfect estimate for what this might look like, the stock market often provides a good signal to rely on. Flywire, as a public company heavily dependent on international payments into the US, is a good barometer to look at.

The company’s stock price is down -66% this year, primarily driven by reduced expectations for international enrollments (and therefore international payments). Read more here.

What this means for the 2025/26 Academic Year, and strategies to alleviate the “hangover”

Expectation #1: More enrollment drops later into the semester

I expect we will see a higher amount of enrollment drops later into the semester than usual as these cost of living increases catch up with students over the weeks (and maybe months) after they start the 2025 Fall semester. This will likely mean a longer ‘busy’ period for Bursar and Financial Aid offices dealing with these students.

It is really important to note here that this might impact returning students more than freshman. Existing students will have a baseline they are relying on from last year that likely won’t factor in price increases - placing them at greater risk of not budgeting appropriately and getting themselves into trouble.

What can we do about it?

Embed financial literacy more prominently into admissions and orientation programming. Something as simple as an orientation slide that says “plan for an extra 10% in living costs” at parent/student orientation might be the difference.

Invest in student engagement automation (I spoke about that more last week).

Better highlight tuition insurance from someone like GradGuard; tuition can be covered in the event a tuition payer loses employment.

Potentially adjust enrollment numbers to account for a higher than expected enrollment drop rate - ideally this minimizes impact to total enrollments.

Expectation #2: Increased sources of payments as students ‘piece’ together tuition funding

In April, consumer confidence experienced a significant decline, plummeting to its fourth-lowest level on record since 1952. The decline was widespread affecting various demographics, including middle-income families, and those across age, education, income, and political affiliation, driven by concerns about a potential recession and rising inflation.

Why do I bring this up? When consumer confidence is low - everyone starts looking for ways to scrape pennies together. That means that the $250 scholarship that was too much work to apply for, is now very much worth applying for. This also means more, smaller payments coming into the Bursar office this semester - and unfortunately, usually the type that come in via paper check.

What can we do about it?

Make a concerted effort to replace processes that lead to mail/email paper forms and payment via paper checks - these are highly manual processes that take a long time, time that will be needed for more important things this semester.

Think about adding a system around processing inbound scholarships etc. in one or two large blocks at a time during the week, and communicating that to stakeholders. It’s kind of like clearing your email - if you try and do it one by one, it becomes a distraction and unproductive.

Find ways to automate communications to students and providers of payment. Sometimes fielding questions about these types of external payments are more time consuming than the check itself!

Expectation #3: Additional resources will be few and far between

Given all this will be happening at the same time that university budgets continue to be squeezed, the likelihood of additional resources to help manage all this will be unlikely. This is an opportunity to rethink how existing resources can do more high-value strategic work by upskilling your workforce.

Cashiers are a great example - with technology that reduces manual efforts, more time can be used on building engagement services, financial literacy and even attending orientation events, creating more ‘bang for buck’.

What can we do about it?

Use the next couple of months to identify manual processes that can be replaced with technology - quick wins that free you up to focus on students

Invest in additional engagement with students and parents at orientation (I know you are all thinking “thanks - we’ve been trying that for years”, but using the current economic situation as a way to start the conversation might create more engagement vs the usual “how to pay your bill” discussions.

Expectation #4: Higher usage of payment plans

Anecdotally, I have heard a number of parents looking to smooth out tuition payments this semester given market volatility eating into their savings. Even if a family has enough to cover the costs in a savings vehicle like 529, they might view paying for a payment plan worth the cost to dollar-cost-average their withdrawals.

The other thing that likely happens with these payment plans is the default rate actually ends up higher. This could end up being fairly consequential to the bottom line, and something to really be cognizant of. More balances in payment plans, with higher default rates, can really add up quickly.

What can we do about it?

Model some higher usage scenarios to ensure that it does not create a harsh impact on university/operating cash flow

Revisit overdue/owed balance limits in preparation. Also not a bad idea to put in place some better analytics and controls for tracking payment plan adoption, and potentially even placing some threshold limits at the university level.

Think through engagement plans for early delinquencies (ie overdue <15-30 days). This is the best time to re-engage, so don’t be afraid to ‘over-communicate’. Also might be worth sending some balances to collections earlier in the process.

The long-term tectonic shifts

While these won’t be shocking to anyone, I think the current tariff-driven economic climate will accelerate these two in trends in particular.

Adoption of technology will become critical to the success of University business offices (not just a nice to have)

Tough times have always been the trigger for real tech adoption. When budgets shrink, technology stops looking like a threat and starts looking like a lifeline — a way to boost productivity, win bigger budgets, and build stronger teams. With hiring freezes and squeezed operating dollars, universities won’t have the luxury of clinging to manual, offline processes. They’ll be chasing maximum bang for every buck. Bursar offices are sitting in a prime spot to lead this shift, using fintech tools to cut friction, speed up operations, and deliver better outcomes for students and the university — not just surviving the squeeze, but coming out ahead.

Let’s take processing Outside Scholarships as an example. I know that today, this process is a largely manual and administrative one - but wait! What if, with technology, we could get rid of the manual processes and actually provide a platform that engages scholarship providers better for the University.

I’m being a bit playful here, but what if:

Scholarship submission and payment come online; eliminating manual work.

If payments were made online, you could process refunds with a click of a button versus hours of making contact and sending checks back.

Would that give you back 5 hours a week, 10 hours a week - and what is that worth in dollar terms?

What if having a centralized reporting tool meant that you could better see who your scholarship providers are, and perhaps engage with them better?

You might be able to see that scholarships have been growing from a particular provider YoY, and engage to create a partnership for more students?

Could you highlight to your students that a submission deadline for a scholarship that usually comes to your University is coming up?

Could you see that a scholarship provider that used to send scholarships isn’t anymore, and focus on bringing them back?

If any of the above come true, all of a sudden this process isn’t a cost-center - processing manual forms and checks. It is an innovation and engagement center that might just be the reason for students not dropping because they found new funds.

International enrollment will take a hit short-term, and need diversification in the long-term

Tariffs, and general political pressure on immigration, is making international students rethink U.S education, which will likely result in slowed growth of international students (or a reduction) in the short-term. In the long-term though, this likely means that Universities will need to look to diversify its international student population to shore up a pillar of its financial budget - international tuition.

Chinese students in particular are feeling the heat. Last year, India officially surpassed China as the largest population of international student nationalities in U.S. universities.

It’s not all bad - international undergraduate enrollment is still projected to grow at a decent clip in the medium and long term, driven by continued diversification of source countries. India is an obvious source of growth, though there are other entrants that will contribute significantly.

South Korea: Stable, but growth has flattened.

Vietnam: Significant growth over the past five years.

Canada: Consistent, though smaller volume (though will be impacted by visa restrictions and how the trade war plays out)

New growth regions include Nigeria, Bangladesh, and Brazil, driven by increasing middle-class demand and aggressive U.S. recruitment strategies

Wrap Up

I hope this was an interesting piece - I know a little longer than usual, but I did want to go deeper into some tactics and strategies that could be implemented this semester. As always, please feel free to reach out with questions!

See you next week.

Cal