Bursar Bulletin: 'Agentic Commerce' has the potential to transform student payments

How 'Agentic Commerce' could hold the key to turbocharging the productivity of the Bursar office. Plus Chime goes public, BofA announces stablecoin development.

Agentic commerce isn't just another payment method. It's a transformation of how payment methods are used, akin to how online stores replaced brick-and-mortar (you know, before Bezos owned everything).

Just like Fintech pulled the Chief Digital Officer from the back office to the boardroom at large banks, agentic tools can elevate Student Financial Services into a strategic force on campus - particularly given today’s enrollment climate.

This week I will dive into:

What is agentic commerce?

How can it be used?

Where is it already being used?

How could it be used in existing Student Financial Services workflows?

First things first - what is agentic commerce?

Agentic commerce refers to AI agents acting on behalf of an individual (usually a consumer) to make a purchase online.

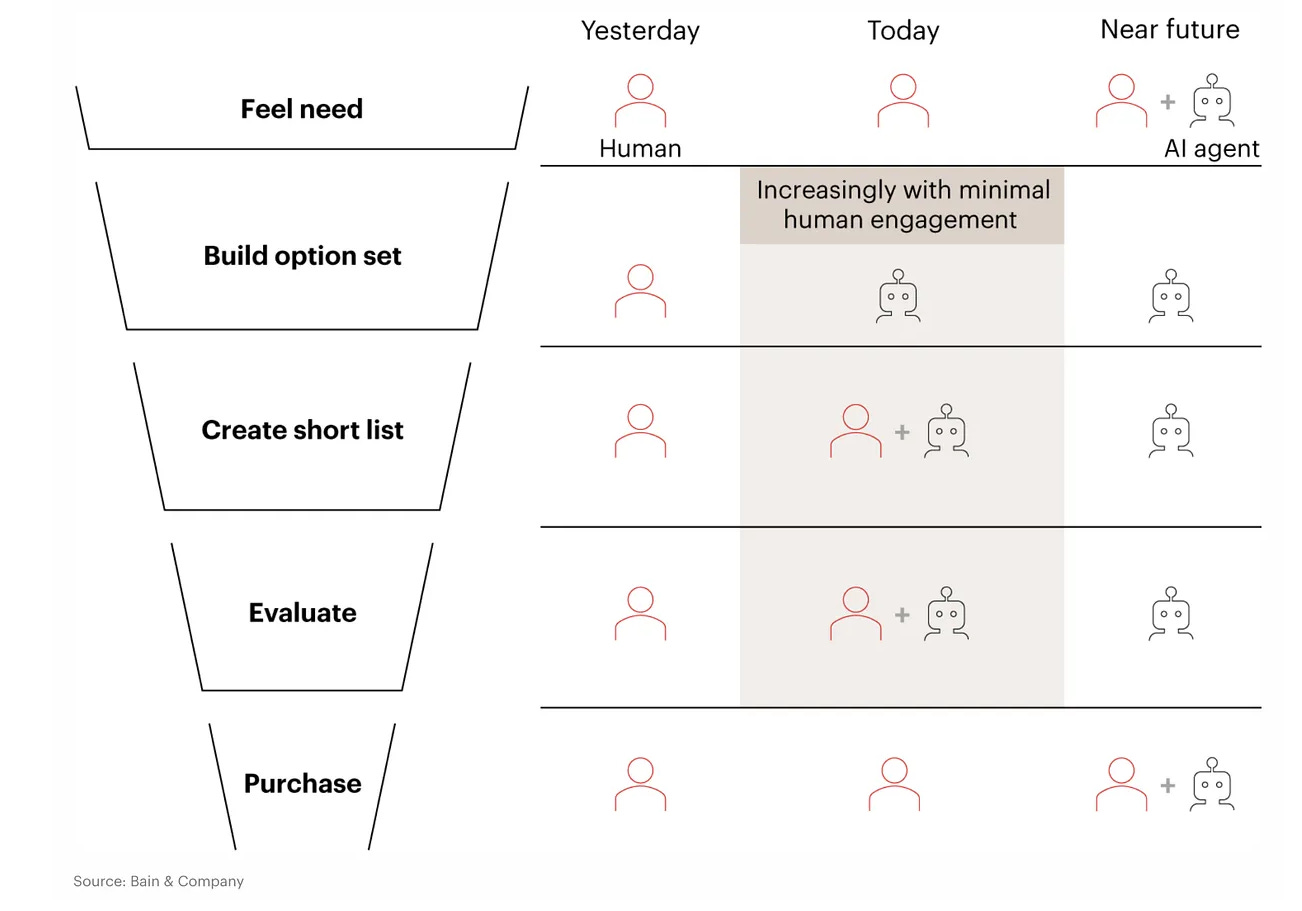

The below illustrates it all pretty well. Where humans usually progress through the buying journey linearly and manually, the point of agentic commerce is that a human can empower an AI agent to transact on their behalf, guided by a pre-defined set of rules like don’t spend more than I earn (though if you’re like me, you’ve probably violated that rule more often than you’d care to admit!).

How can it be used?

There are a few different models for agentic commerce, and my guess is the future will utilize a combination - all of them seem like they can be suited to specific circumstances. I like to think about it (albeit simplistically) in three models:

Instructed: The Agent executes the transaction with a human in the loop - an example where the Agent does the searching, but human pays.

Authenticated: The Agent gets authority to use a humans wallet (Apple Pay).

Funded: The Agent has access to its own funding. This could be limited in nature (a capped or one-time-use virtual card) or more broad (like its own wallet).

I was chatting to someone about this the other day and the track we went down led us to an analogy that I thought was quite helpful - how a parent interacts financially with their kid. I’m sure there are times where you encourage your kids to pay with a lot of oversight to build their confidence (Instructed), or perhaps give them your debit card to pay for a specific transaction (Authenticated), or even give them an allowance each week to make more self-determined choices (Funded).

Where is it being used already?

While this stuff can always feel a little theoretical, there are actually some pretty cool examples of this happening out in the wild already.

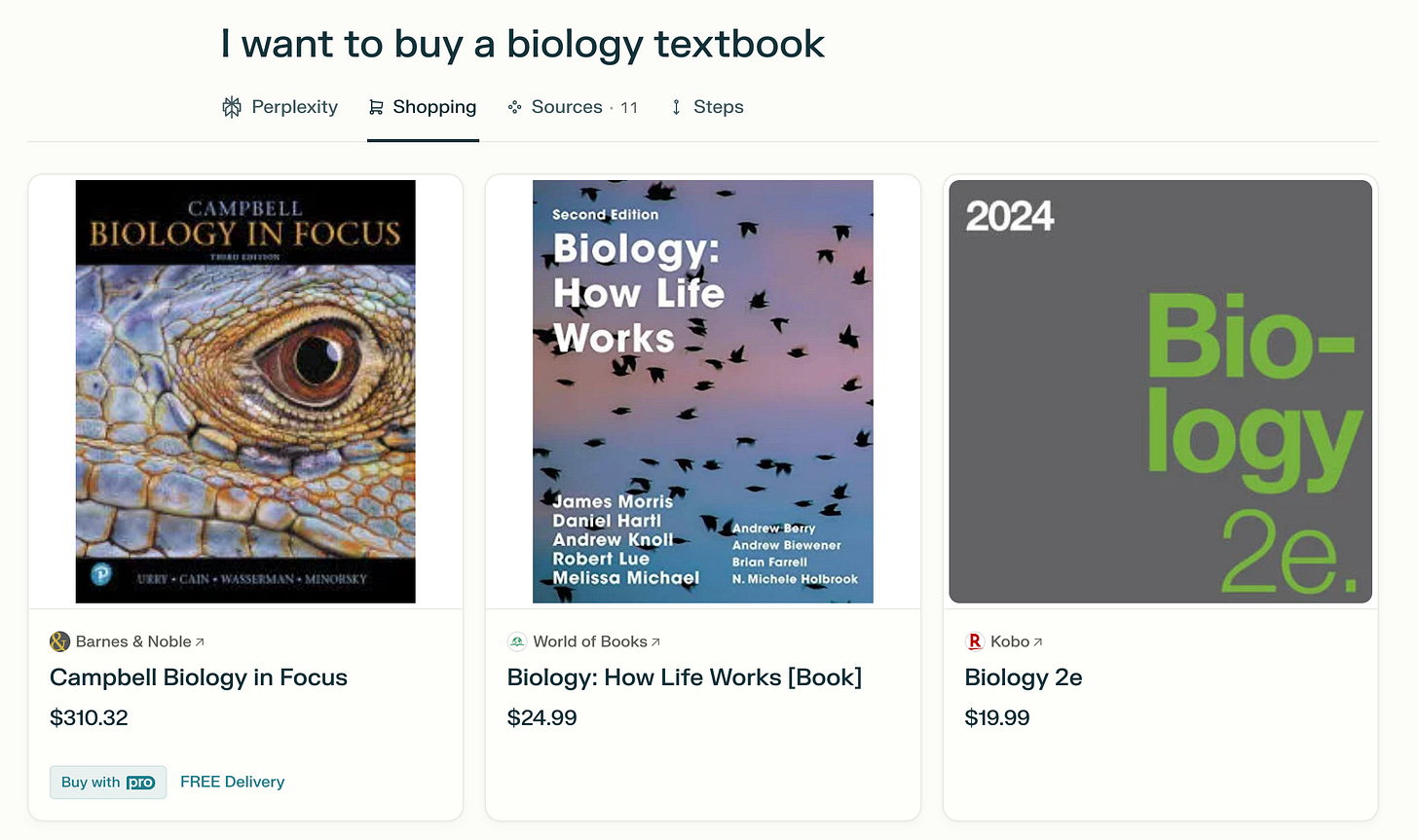

I wrote about Perplexity and PayPal’s new partnership a couple weeks back, so figured I’d test it out and show you in real life. I typed in “I want to buy a biology textbook”, which then surfaced multiple options, and you can see the Buy with PRO label on the far left option. Starting this summer in the U.S., consumers can check out instantly with PayPal or Venmo when they ask Perplexity to find products, book travel, or buy tickets. This is the beginning of ‘conversational commerce’.

Where does it fit into Higher Ed payments?

You all know me well enough by now that I am generally an optimist on how these new technologies can enhance process for Bursar teams and student families. I am also acutely aware some of what I write probably gets met with a decent amount of cynicism (which is fair enough!).

I have no interest in talking about the pie-in-the-sky possibilities here for Student Financial Services, but I do think there are three really interesting aspects of what we do where it could create positive change.

(1) Helping students find additional funding

I know for a fact that a huge part of both the Financial Aid and Bursars office roles are to make sure students get the access to the best education funding out there. The reality is that there are often gaps that need to be covered using private student loans, outside scholarships, or other types of grant and external funding. Today, a lot of this is very manual - and that unfortunately means that not all stones are unturned.

This is a huge opportunity for ‘agentic commerce’ - providing an AI agent with the context of a student’s education and financial situation, and pairing it with its unparalleled ability to trawl the web, will enable these agents to surface the best options available to a student to pursue.

To use an example, let’s say we have a student with a $10,000 funding gap.

Our AI agent might return a list of eligible scholarships that total $5,000, with an understanding that the probability of getting them is 50%, meaning realistically that’s $2,500 in funding. It then might return the top 3 options for private student loans for $7,500, based on the student’s financial situation (credit score etc.).

(2) Enrolling students into payment plans

AI agents could play a really interesting role here that does two things; firstly, reduce the amount of manual effort from us to enroll a student into a payment plan, and secondly, drastically reduce the drop rate by better contextualizing plans for each individual. I think there is a short-term and a long term version of this.

In the short term, AI agents could act in a hybrid Instructed/Authenticated way. Student families might connect a primary financial account, and the AI Agent would find the best suited payment plan option the University provides, and transact to fulfill the up-front payment required to secure enrollment. This could help solve a lot of the confusion some families have with payment plan options, and reduce the amount of time you spend answering those questions one-by-one.

In the long term, payment plans could be contextualized to the need of each individual student family. I know that CRM constraints also end up constraining the number of payment plans you can offer - but what if an AI agent could assess each student family’s unique financial situation, and create a payment plan within some university established guidelines that meets both goals. This would be a huge step up in accessibility and affordability provided to student families - how many students have dropped because they might not have had the liquidity for a few weeks that your payment plan option demanded right now?

(3) Automating pre-collections work

This part excites me a lot because I think it has huge potential to solve the small-dollar balance problem, which is still associated with a big time suck on your end.

There might be a world where students are required to link an external account (lets use PayPal for example) upon enrollment for the explicit purpose of resolving small dollar balances. The university could create rules around its use, but the point is that an AI Agent could transact on behalf of the student if an outstanding balance was below a certain dollar threshold.

Let’s use an example of a student who has graduated with a $120 on-campus parking fine they never paid. In our existing reality, the likelihood is that this balance stays unpaid for years, or maybe even decades. Using agentic commerce, after communications about the transaction go out to the student, the AI agent could transact on behalf of the student to pay off the outstanding balance. In this world there would be no manual work for either the Bursar or the student!

While I know it isn’t as simple as it seems, and there are always considerations about making students pay, I also know that a lot of times students don’t mind paying - they just can’t for the life of them remember their payment portal login they haven’t used in 12 months! This would solve that.

What else happened this week?

Chime (very successfully) went public this week. Read my newsletter on their business here, or more about the IPO day here.

Bank of America announced, via its CEO, that it is joining the stablecoin party. Read more here.

Shaq is set to pay $1.8M to settle the lawsuit stemming from his involvement in the FTX debacle - everyone likely remembers Sam Bankman-Fried as the crypto company’s CEO that ended up in jail. Read more here.

See you all next week!

Cal